Which fleet philosophy would you subscribe to?

Fleet 1: Meet Ron. Ron owns a fleet of 50 for his HVAC business, and he’s on a budget. That’s why he buys used vehicles and plans to use them until the bitter end. The great part is, he doesn’t have monthly payments on the vehicles. In fact, in October, fuel was his only major fleet expense.

But then the wheels started to fall off. Over the course of a few weeks, seven of Ron’s vehicles had major breakdowns, temporarily cramping his cash flow and causing his employees to miss customer appointments. Ron struggles to keep up with successfully running his business as he simultaneously manages his fleet. Frustrated with the junky vehicles and work environment, a few members of his team quit — but Ron thinks he’s saving money.

Fleet 2: Across the state, Sharon works for Ron’s competitor. She manages a similar fleet of 50 and budgets accordingly. Every month, she has a predictable payment schedule for her fleet of new vehicles — which costs her more month to month than Ron. She has to dish out money for small repairs here and there, but doesn’t have any major failures because she stays on top of preventive maintenance. Her company’s driver retention is at an all-time high, and more talent continue to apply to work at her company.

When you hear their stories, which fleet do you think will be more successful — the one that saves money by taking worn-out vehicles to their deathbed, or one that prioritizes driver satisfaction and safety? Are Ron’s monthly savings really worth the sudden vehicle breakdowns? Or is Sharon paying too much for her vehicles? We have some theories, all related to the vehicle life cycle…

What happens when you take your vehicle to the bitter end?

Increased maintenance expenses

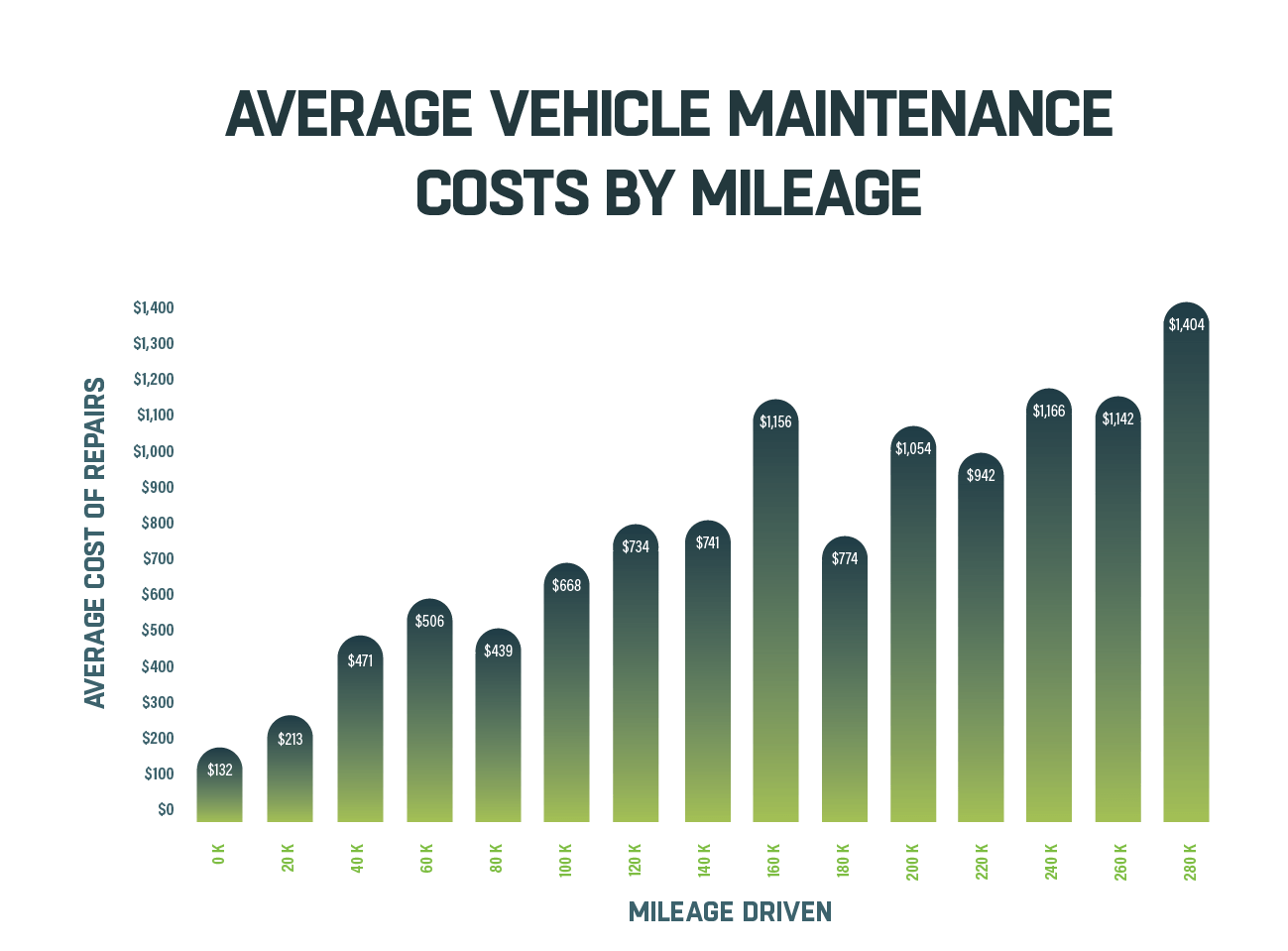

The data doesn’t lie: once a vehicle hits a certain mileage, its maintenance costs increase exponentially. A single vehicle owner may be willing to take that risk — no car payments, but a little extra saved up for a vehicle emergency. But when a business fleet suddenly has a blown out engine and two broken transmissions in a two-week span, that doesn’t fare well. Unpredictable costs can cause issues in a company’s bottom line and cause financial hardship, highlighting the importance of that vehicle life cycle. Find more information on how to reduce maintenance costs from our Fleet Studies Lab.

Diminishing resale value

Mileage is everything, especially for those in the market to buy used vehicles. A buyer may be willing to pay $9,000 for a vehicle with 150K miles on it — but as soon as that mileage goes higher than 150K, that value could dip to just $6,000. When you creep up to 250-300K miles, it’s only a (short) matter of time before the vehicle needs a maintenance repair that costs more than it's worth in its vehicle life cycle.

Losing customer goodwill

When your vehicle life cycle ends, and its time for a vehicle replacement, you have to scramble to make that last delivery. That means your drivers waste time sitting at a shop. It means you could potentially lose valuable business relationships when you can’t deliver. And it means you either need to pay for a rental vehicle to meet your obligations, or make a snap decision to buy a new fleet vehicle. Oftentimes, that vehicle will be from a dealer lot with more options than you need. You’ll pay 10-20 percent more than you would if you’d planned further in advance and picked only the features you need.

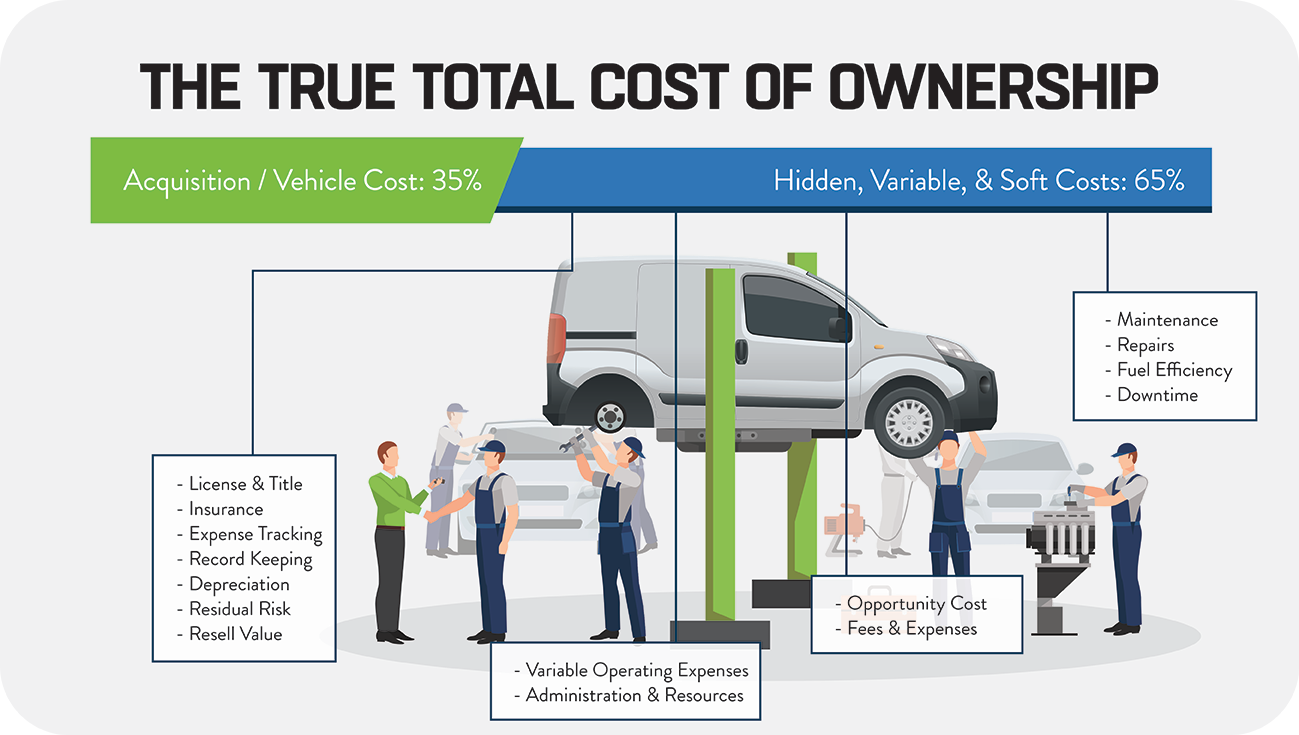

What really goes into the total cost of ownership (TCO calculation)?

When you buy a replacement vehicle, you pay for far more than the price tag says in things like driver downtime. But do you know how to find average total cost? Here are a few of the considerations when calculating the operating costs of owning a vehicle for the vehicle life cycle:

Up-front vehicle cost

This may mean paying in full up front, but more likely it’ll mean a big down payment as well as monthly payments for 60+ months.

Maintenance expenses

Oftentimes, brand new vehicles will be covered under warranty for the first few years of maintenance expenses. However, that doesn’t include potential accidents or wear and tear. You’ll still be footing the bill if your driver gets into a fender bender or scratches the vehicle.

Asset depreciation

Unlike fine wine, when your vehicles age, they quickly lose value. After five years, the average vehicle will lose 60 percent of its value (up to 30 percent of that in the first year alone). For example, if you buy an average sedan for $25,000 and take great care of it, it still will only be worth $9,000 in five years.

Fuel efficiency degradation

If you aren’t keeping up with proactive maintenance, your car will run into a plethora of problems, one of those likely being fuel efficiency degradation. That means you’ll be digging out more money for gas, along with dealing with engine problems.

Resale value

Many used-car buyers will have a certain mileage that they are comfortable with, so you should be aware of that limit. When your vehicle has a decently low mileage and is otherwise well taken-care of, it’s going to fare better in the auction lane. Learn when you should sell your commercial fleet vehicle with this article from our Fleet Studies Lab.

What about the Section 179 deduction for vehicle ownership?

The short answer: It probably is not in your best interest. In general, there are a few cases where fleets may benefit from an accelerated depreciation strategy for section 179 vehicles for accounting reasons. But just because you get a tax credit this year, what will you do for next year? Will it benefit your fleet in a long-term strategy?

To lease or not to lease

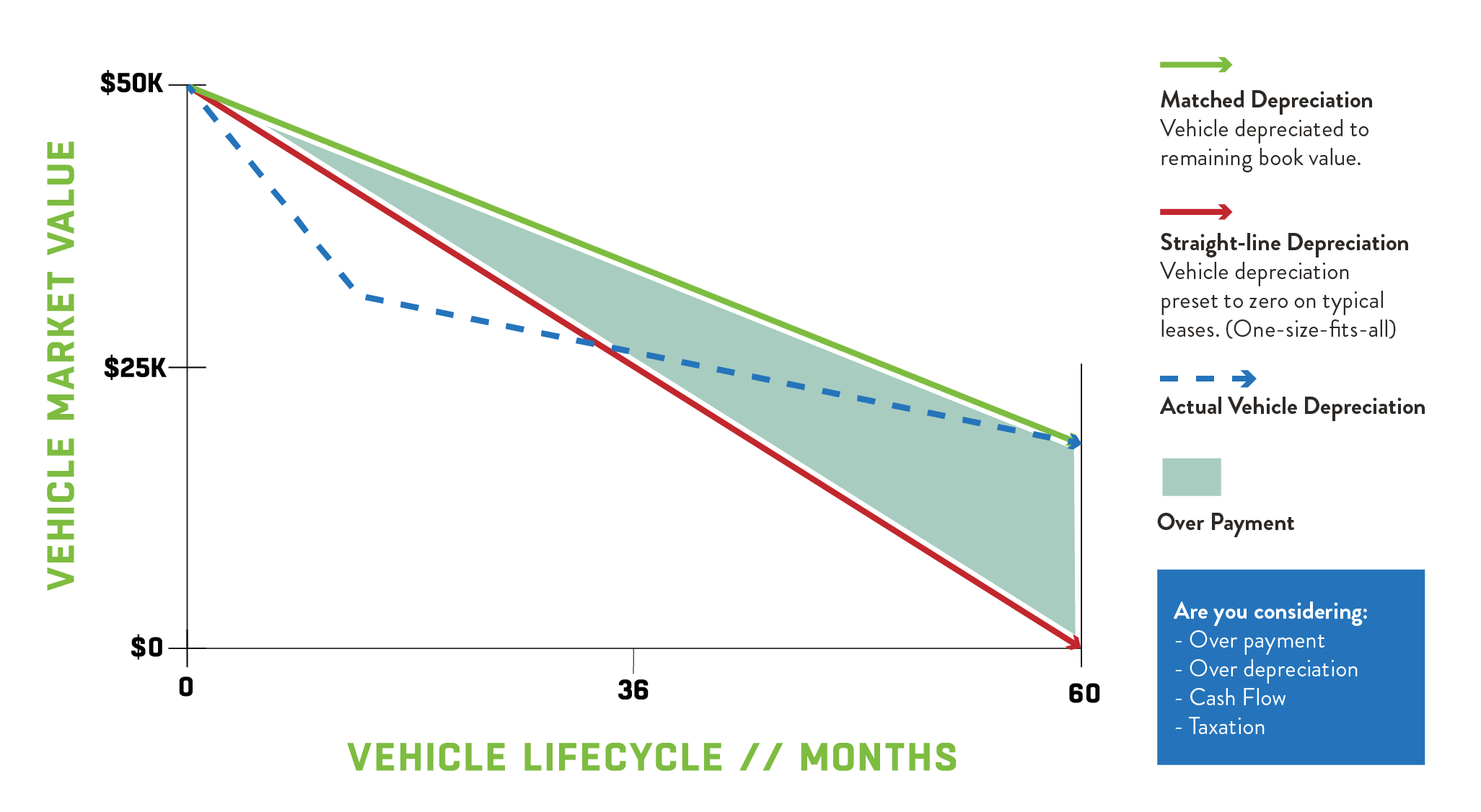

If you subscribe to an ownership philosophy, paying for a vehicle for 60 months and not owning it can be a tough pill to swallow. It’s time for a perspective change — the vehicle life cycle. Buying a car for yourself is a lot different than buying one for your business. Think of leasing fleet vehicles as a way to free up cash every month.

Rather than paying a high price point up front for the opportunity to resell your vehicle many years from now — you’re instead choosing to pay only what you need to use. And you can gain more consistent reliability while cutting the hassle of off-loading a used vehicle.

You might think of fleet leasing like you do your accountant. You want your accountant to tell you the absolute minimum you can pay in taxes, right? Would you agree to overpay your taxes for the next five years all at once in the hopes of getting a credit back after five years? Hopefully not. When you own fleet vehicles instead of leasing them, it’s the same thing. You overpay up front to get a small amount of cash back years later (that’s not even guaranteed).

What strategies should I deploy to minimize my total cost of ownership?

1. A matched depreciation strategy

Experts can help you build a lease that matches the true depreciation of your vehicle, so you hit the sweet spot in cost savings. Think of it like this: Instead of depreciating to zero, it’s a better idea to depreciate to the vehicle’s remaining book value — to match its fair market value.

Here’s an example. Under a matched depreciation strategy, you might depreciate your vehicle to $9,000 rather than $0. You’ll then sell it for $9,000. This way, you’re only paying for what you use as opposed to overpaying. (Under a regular depreciation strategy, you’ll have to pay taxes on the amount you sell it for). Since it’s on a 60-month payment plan, you’re still hitting the sweet spot to avoid over depreciation with aging vehicles.

Another way to think about it is getting a free sixth vehicle for every five vehicles you lease. How, exactly? Under this strategy, you could save $100 a month. So if you’re paying $500 a month versus $600 a month on five vehicles, that means you can afford to put a sixth vehicle in your fleet for the same monthly cost. That’s just math. (And a vehicle life cycle strategy).

2. A plan to cycle out vehicles at the right time

This is where the experts come into play to help establish replacement cycles. You might currently implement a rough rule of thumb, like knowing you need to cycle out vehicles about every five years. However, there is risk in this strategy. Without knowing benchmarks of each of your vehicle models, data about their mileage and when each model needs maintenance, you may miss the mark.

- Cycle out vehicles with much longer vehicle life cycles too early and you waste money you could have saved by keeping a sound vehicle on the road.

- Keep underperforming vehicles in your fleet for too long, you run into skyrocketed, unplanned maintenance and plummeting resale values.

3. Using experts to ensure you’re choosing the right vehicle for the job

Look for an expert with your best interest at heart. You don’t want to turn to someone who wants you to cycle in expensive vehicles just so they can cash in a higher commission check. Rather, choose an expert that treats your money as if it were their own. Go with people who can show you real data and give you logical reasons why.

What are the side effects of adopting a vehicle life cycle strategy for my fleet?

1. Predictable expenses

Think about it: if you told your company’s CFO “I can create a predictable expense stream for our number-one biggest expense — our fleet.” You’ll be taken pretty seriously, right? When you take advantage of vehicle life cycle strategies, you can do just that. Dealing with unplanned repairs in an older fleet leads to spiked expenses — but refreshing a young fleet every five years is a flat expense.

2. Customer goodwill

Reliable vehicles are the foundation on which you can build your reputation. Consistently showing up on time, in a well-maintained vehicle delivers a strong message. And the financial impact of a breakdown goes beyond the repair costs: If your driver gets stranded on the side of the road and can’t make his runs, you’re going to have a dissatisfied client. Running late can leave customers frustrated, and cancelations could lead to losing major business.

3. A refreshed brand image

Your vehicles are moving billboards that say more about your company to potential customers than you may realize. Adding your company’s mark to the side of high-quality vehicles means you’ll get more free advertising and attention simply by driving around. And you won’t be embarrassed if it’s on an old clunker.

4. Driver retention

It’s just a fact: When drivers are in respectable vehicles, they’re going to look forward to their daily routes and take pride in what they’re driving. People treat new cars better and treat beaters like beaters. They might even feel shame in driving something that breaks down or makes them look bad. As the service industry struggles to find talented technicians in popular fleet industries like HVAC, plumbing and electric, keeping these drivers’ morale high is key to retaining talent.

5. Less accidents

The U.S. Department of Transportation began requiring all vehicles made in 2014 or after to have backup cameras for rearview visibility, and many more new cars also include GPS navigation directly in the screen (so drivers won’t have to fiddle with a separate device for directions, lessening driver distraction). Additionally, the market for Advanced-Driver Assistance Systems will go from $27 billion in 2020 to $83 billion in 2030. Why? Their ability to prevent accidents. When your fleet vehicles are safer, your unexpected costs from accidents go down.

What should I look for in a finance strategy specialist?

Expertise in all things fleet

A great specialist will not only have knowledge of industry benchmarks, but they’ll also have expertise in remarketing. That way, they’ll be able to predict how well your current assets will fare in an auction and can make better decisions in your fleet’s best interest.

A data-driven approach unique to you

If a specialist has cookie-cutter rules or one-size-fits-all approaches, that means they’re not leveraging the potential of fleet data. Vehicle life cycle strategy recommendations should be unique to your industry, goals and fleet vehicles.

A knowledge of matched depreciation

Don’t go with a specialist who’s going to overdepreciate your fleet. They likely don’t have your best interest at heart. An experienced finance strategy specialist will treat your money as if it were their own, developing a finance strategy that’s truly in your best interest.

Want to know more about vehicle life cycles? You can turn to a depreciation calculator, or you can talk to a real person. Contact us for a no-strings-attached, free fleet consultation today.