You gave your fleet vehicles a good run. They were reliable, well-used and took your business places you never thought it could go. So when it’s time to sell them, you’ll want to maximize their return based on the use, tools and environment in which you’re selling.

If you run your vehicles until the tires fall off, chances are you won’t be happy with what you’ll get in return. That’s why it’s always a good idea to consider your vehicle’s strategic vehicle life cycle. Instead of planning for vehicle disposal, consider strategic vehicle remarketing.

What is vehicle remarketing?

Vehicle remarketing (or fleet remarketing) is the art of selling used cars. And yes, we’re referring to it as an art, because in order to get the best return on your fleet vehicles, it takes meticulous attention to industry forecasts and trends, knowledge of all vehicle makes and models, and the right industry connections.

While fleet managers often opt to dispose of their vehicles (assuming there’s no value left in them), vehicle remarketing is a better alternative.

When you work with an experienced remarketing partner, they’ll do all the work to properly position your vehicle into the most suitable fleet vehicle remarketing channel. Thanks to their expertise in the vehicle remarketing space, they’ll work to broker the best deal possible based on your specific vehicle’s situation.

The vehicle remarketing process

Make a plan.

Call your remarketing partner and let them know you have a vehicle that is ready for retirement and needs to be picked up. They’ll ask for the vehicle’s location, an identification number and a contact person who can give them the keys. They’ll then share this information with one of their strategic disposal partners.

Evaluate and recondition vehicles.

Next, the remarketing partner will evaluate the vehicle and create a full condition report listing any issues that need to be fixed to get your vehicle in pristine, auction-ready condition (think: buffing out scratches, addressing any check engine or ABS lights, removing any identification decals and doing a deep clean). If they determine vehicle reconditioning could get you $3 for every $1 spent, they’ll invest in it on your behalf. If not, your vehicle will go on sale as-is.

Wait for a sale.

Your vehicle then gets posted on a variety of marketplaces, both digital and physical, maximizing it’s visibility and sale opportunities to a variety of different buyers. If it doesn’t sell prior to a weekly physical auction day, it goes to a physical auction where buyers can make an in-person or digital purchase of the vehicle. From there, you can expect to see the funds as a credit in your next invoice in approximately 28-32 days.

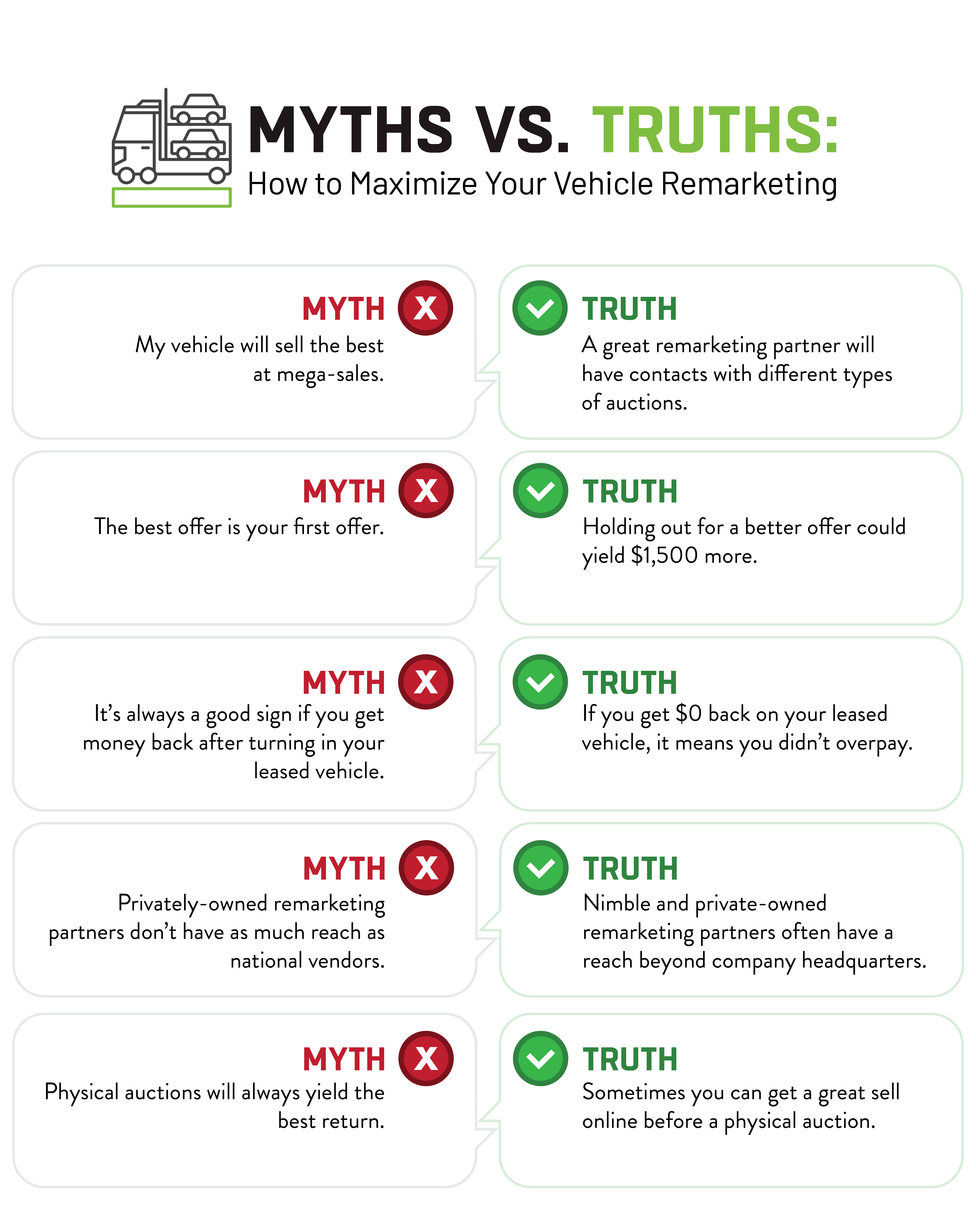

The Top 5 Vehicle Remarketing Myths:

There are a number of misconceptions around vehicle remarketing. Should you think about vehicle reconditioning? What type of fleet vehicle auction should you consider? Check out these mythbusters for the real truth about remarketing.

MYTH: My vehicle will sell the best at mega sales.

TRUTH: A knowledgeable fleet remarketing partner will help you determine the best vehicle disposal method for your business.

→ If you’re selling a Toyota Camry at a mega sale with 25 other Toyota Camrys, your vehicle might not get much interest. That’s why some vehicle remarketing partners have built relationships with national chains and independent mid-major auctions. These will have a unique buyer population and oftentimes a lower number of similar vehicles being sold, so yours stands out. Mega sales and auctions aren’t the only options, either—selling a used fleet vehicle to your driver or to a dealership can be viable alternatives (and you won’t have to pay auction fees or transportation fees in those instances).

MYTH: The best offer is your first offer.

TRUTH: Holding out for a better offer could yield $1,500 more.

→ Don’t push for a sale that’s fast but not very profitable. Some companies will boast a fast turnaround, but they’re not giving you the full picture. Waiting a little longer—a few days or a week—can yield bigger profits. Although selling fast is convenient, most people are happy to hold out a few days for an extra $1,500 for their bottom line. A great fleet remarketing partner knows your vehicle’s true value—and if it doesn’t sell for that price right away, they’ll wait for the next auction and run it again.

MYTH: It’s always a good sign if you get money back after turning in your leased vehicle.

TRUTH: If you get $0 back on your used fleet vehicle, it means you didn’t overpay.

→ Think of leasing vehicles like you do your tax returns. Your goal should be $0 received and $0 owed. If you get a refund, it means you overpaid throughout the year. If you owe money, it means you need to close a gap. Although it may feel good to get $50,000 back into your business when you turn in 10 of your assets, that may be an unbudgeted, unplanned and taxable event—and accountants don’t like surprises.

MYTH: Privately owned remarketing partners don’t have as much reach as national vendors.

TRUTH: Nimble and privately owned fleet remarketing partners often have a reach beyond company headquarters.

→ Sometimes the nimblest fleet management companies have the least red tape and some of the best talent in the business. Many have built meaningful contacts with dealers across the country. Plus, a private company will often hold off until the market is better if that’s in their client’s best interest. In contrast, a corporate machine won’t always take seasonal considerations into account—they need to hit a quota and keep busy, so they’re quick to convince you to sell low.

MYTH: Physical auctions will always yield the best return.

TRUTH: Sometimes you can get a great sale online before a physical auction.

→ These online sale alternatives are sometimes referred to as “upstream remarketing channels,” and they were taking off even before the pandemic changed the way dealers bought and sold used cars. Upstream channels are like digital marketplaces where buyers can scroll through options. They allow you to list vehicles to a much larger audience and sometimes even yield a better return (and less money spent moving cars and reconditioning them for auctions).

The current climate for pre-owned vehicles.

Why were used car values so high, and what can we expect moving forward?

The first few months of the pandemic were defined by unpredictability and panic. In hindsight, late summer and fall turned out to be a good time to sell cars. No one truly knew what would happen in the used car industry in March of 2020. Fleet management companies recommended not succumbing to knee-jerk reactions: Stay the course and do what you did in prior years.

That turned out to be sound advice. Pre-pandemic, the average used vehicle sold for $19,270. In August 2020, however, the average used vehicle was worth $20,245—and as of February 2023, the average was $26,510. Like most industries, the fleet world was shaken up by COVID; there was a low supply of cars driven by chip shortages and supply chain disruptions, but an extremely high demand for vehicles due to boredom, lockdowns, and extra capital from stimulus checks.

We’ve seen some changes recently, however. New and used car prices appear to be leveling off due to inflation and high interest rates—so fleet managers aren’t guaranteed to get the same amount of money for their used fleet vehicles that they would have gotten three years ago.

Is it still a good time to sell used cars?

In 2020 and 2021, it was particularly effective to purchase used cars, due to the impact the pandemic had on new car production. With fewer vehicles being manufactured due to shutdowns and supply chain issues, demand for used vehicles was way up.

However, fleet owners are in a precarious position when it comes to selling their used cars today—because even if they can get a good price for remarketing their vehicles, they might still struggle to get new models to replace them. Ordering constraints for new vehicles have been a major issue for fleet managers over the last two years; as a result, the life cycle of fleet vehicles has been extended (and proper maintenance has become even more important).

Now, as manufacturers are finally catching up on production and delivering vehicles following long delays, the used cars that should have been replaced and remarketed twelve to eighteen months ago are flooding the market—with more wear and tear and higher mileage than usual, lowering their value. That being said, if you have used cars to remarket, “the sooner you can sell, the better,” says Matthew Gast, director of remarketing and vehicle valuation at Mike Albert. “Even though the market is settling, you’ll still be getting a higher amount for your vehicles than you would have had the pandemic not happened—especially if you’ve been performing appropriate maintenance to keep your fleet in top condition.”

Find a company that makes a difference

You should be as thoughtful and strategic about the disposal of your vehicle as you are about acquiring it in the first place. But getting the best return on your used car sales might as well be a full-time job. For many people, it is. Fleet management companies and remarketing partners have the know-how on industry benchmarks, trends and connections to get the best bang for your buck.