Fleet affected by the supply chain shortage? Here's what to do.

Microchips and upfitting materials aren’t the only things in low supply, with high demand and rapidly inflating prices. Other materials necessary to vehicle production are also in short supply. Learn how to work around this issue.

In 2021 the global auto industry made 1.5 to five million fewer vehicles than originally expected due to supply chain issues. Ironically, Americans are buying new vehicles at the fastest pace in years, causing demand to outpace an already-dwindling supply. Businesses and organizations that rely on vehicles to move their people or products from A to B are now having to compete for a place in line when it's time to add or replace this crucial part of their operations.

The auto industry is facing a major microchip shortage. Automakers expected a lower demand for new cars last year and decreased their microchip orders, which are a necessity in new vehicles. However, vehicle demand increased beyond their predictions. When consumers bought up the available microchips for electronics, the auto industry was left with a big shortage of new cars available for sale — and the fleet industry was left with unfulfilled orders.

“Clients, in some cases, are getting frustrated because I don’t think they understand the severity of what’s going on,” said Chris Knosp, Vice President of Business Development at Mike Albert. “In the past, they could get vehicles from a dealership because there was always excess inventory. That is not the case now.”

These shortages of microchips and other vital car parts can be attributed in part to adjustments made for social distancing measures from 2020. Manufacturers went from full shutdowns in spring of 2020, to ten percent capacity of workers, up to mid-capacity and so on as the year progressed. This caused manufacturers to re-shape assembly lines and learn to do their jobs in different ways, which we are still adjusting to in 2023.

Nationwide, there are now stocks of vehicles that are almost complete as manufacturers wait for those last few items that are in short supply to arrive.

What do these supply chain issues and shortages mean for fleets?

-

Increased costs. Vehicles may cost 18 to 20 percent more than fleet managers are accustomed to paying, and rising.

-

Low, or no, inventory. Fleet owners can no longer rely on dealerships to have excess inventory. Many dealers will run out of new cargo vans and pickup trucks by August 2021.

-

Incentives and product availability changes. When manufacturers are selling everything they carry, there’s no need to offer fleet incentives. For 2022, there could be significant adjustments to the rebate programs as well as fleet availability.

-

More expensive upfitting. The supply chain issues go beyond microchips. Materials for upfitting, such as steel and plywood, are also in short supply and high demand, thus driving up prices.

-

An increased need for vehicle maintenance. With vehicles needing to be held onto for longer periods of time, staying up to date on preventive maintenance and repairs is vital.

A supply chain shortage like never before

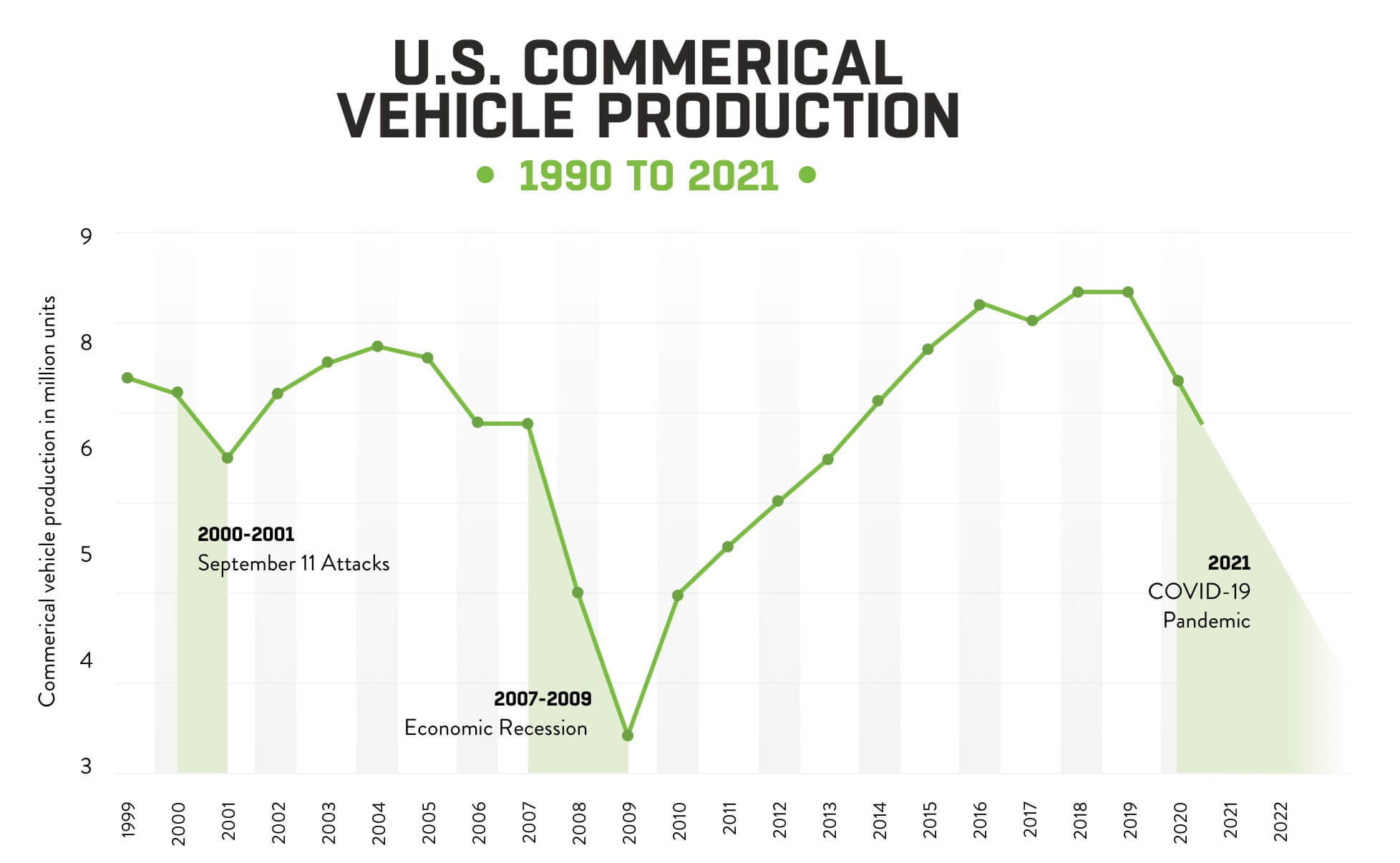

As a society, we’ve been through some tough times in recent history, including September 11, 2001 and the recession of 2008. Economic turmoil typically follows unfortunate historical events, which, in turn, affects the supply chain shortage for fleets.

However, no major event has affected the fleet industry to the degree of this current crisis. In fact, GM’s president recently called the microchip shortage the worst supply chain crisis in the auto industry he’d ever seen.

“The 9/11 attacks contributed to supply chain issues and uncertainty in the world. Then we had the great recession and everybody got nervous about vehicles,” said Steve Johnson, Business Development Manager at Mike Albert. “But that wasn’t like this — this is a situation where you can’t get something. It’s unprecedented. I’ve never experienced it.”

Johnson, who has been in the fleet business for nearly 50 years, recalls when factory ordering would take six to eight weeks to get a vehicle. Today, he says, it’s not worth taking a manufacturer’s word that they will even receive a vehicle in six months. Because of the severity of the shortage, trying to get a specific new fleet vehicle could take years.

Retired, Manufacturer Relations, Manager at Mike Albert Steve Armstrong can attest to that, adding that they’ve had nearly 500 orders cancelled for the year.

“We have to call our clients and break the news,” Armstrong said. “They understand that it’s the manufacturer that causes it, but they’re looking to us for solutions. And we bring them.”

Microchips and upfitting materials aren’t the only things in low supply, with high demand and rapidly inflating prices. Other materials necessary to vehicle production are also in short supply, such as:

- Foam — Polyurethane foam, which makes a vehicle’s seats comfortable, is in short supply due to a massive winter storm in Texas. Because refineries couldn’t produce gas and petroleum, suppliers couldn’t get chemicals they needed to build seats.

- Rubber — Rubber is necessary for many vehicle parts like hoses, belts, vibration-dampening fittings on engines, and, of course, tires. The cause of this shortage can be attributed to several issues like global transit supply, stockpiling by China and the pandemic.

- Upfitting needs — Things like steel products, ladder racks and utility bodies are in high demand as inflation continues to increase. In a year, the price of plywood has gone up 377 percent.

How your fleet can survive and thrive during unprecedented supply chain issues

Don’t wait — get in line now.

Fleet owners should reorder ASAP for vehicles that expire before and August of 2022, Armstrong said.

“We’ve been saying this since September of 2020 — get your renewals and orders in now so you can get in line,” said Armstrong. “The chip problem has not yet reached its maximum effect. It will go on well through this year and through the first quarter of 2022.”

If you’re planning to expand your business, it may be in your best interest to get a vehicle right away — even if it won’t be in use for a few weeks. While you may have to pay more now, if you wait too long, vehicles may not be available at all.

“Right now, dealers have vehicles, although they are expensive,” Armstrong said. “By August, they aren’t going to have any. If you can, it’s better to wait, but if fleet owners need to expand their business, they should acquire vehicles now.”

Free up cash with a purchase lease back program

Some fleet partners offer purchase lease back programs, in which the fleet partner cuts you a check for the full value of your fleet. Then, they lease your vehicles back to you at a lower monthly rate.

“With all the gloom and doom we’ve been talking about, one of the positives is the purchase lease back program,” said Johnson. The big advantage of this program in today’s economic times is the ability to generate capital back into the business.”

Having that capital available allows fleet managers to use money for their business, like hiring and onboarding technicians.

Understand the importance of a proper vehicle life cycle strategy.

A vehicle life cycle strategy refers to cycling out your older, higher-mileage vehicles which are more likely to have major breakdowns, in favor of newer, low-mileage vehicles — allowing fleet owners to have more predictable payments. Under this logic, it makes sense to cycle out a vehicle with 145,000 miles for a newer, low-mileage vehicle.

However, with today’s extremely low supply, a high demand and unprecedentedly high prices for vehicles (if they’re available at all), it makes more sense to hold on to assets for a bit longer.

“You may need to drive a vehicle for 36 months instead of 24, until we can get out of this production quagmire,” said Armstrong.

Because holding on to vehicles for longer means they are more likely to suffer a breakdown, maintenance management is more important than ever. From tire rotations to brake inspections, the right maintenance program ensures your company’s vehicles are taken care of in a timely manner. Managed maintenance programs are a part of all successful fleet operations.

“Let’s not assume that we should cycle a vehicle out because it was the right thing to do in a perfect world. Right now, it is not a perfect world,” Johnson said. “So we have to reexamine our cycling strategies to address that.”

Now is the time to maximize investments with a fleet partner

Today more than ever, fleet owners need a partner who knows how to navigate these uncertain waters. An ideal fleet partner will have connections with OEMs, manufacturers and upfitting services to help you locate assets and ensure they’re road-ready, even during major supply chain issues.

“Fleet partners know which manufacturers you can work with to best provide you with solutions,” Armstrong said. “And it’s not just about getting vehicles. It’s servicing vehicles, maximizing your investments and anticipating future value. It’s never been more important to have an expert at your side.”

The best solutions right now may not be permanent. You may have to spend good money against a “bad” asset because it’s the only option.

Knosp wants fleet owners to remember that at the end of the day, this crisis will subside. However, the best thing to do right now to stay afloat is to get expert assistance on how best to optimize what you have.

“As with everything in the auto industry, it will normalize,” Knosp said. “It will take some time. We have to work harder to provide great consultation for fleets. It’s a place some clients have not been before, but our team can help coach you through it.”