How does a purchase lease back program work?

A Purchase Lease Back (PLB) program, sometimes referred to as a "Sales Lease Back" program, works just like it sounds: A fleet management company (FMC) purchases your fleet vehicles and then leases them back to you. A PLB program can work whether you own or currently lease your vehicles. The goal is to determine the most efficient terms and mileage so that the restructured financing results in the most budget-friendly rate.

By tapping into your fleet's equity, you enjoy an instant cash infusion. "These funds can help drive company growth," says Gary Van Orden, Regional Vice President for Fleet Sales at Mike Albert. "Whether that's brick-and-mortar expansion or the acquisition of a competitor, your fleet's equity can help make those plans a reality."

The details at the heart of the process.

The PLB process is detail-intensive but relatively straightforward. It begins by providing the FMC with a credit application and some relevant data on each vehicle, such as:

- VIN Number

- Year, Make, and Model

- Current Mileage

- Current Payment

- Current Payoff

- A contact at the bank (or other FMC) who currently holds your lease

"There's a lot of detail to consider in these PLB programs," says Allison Kinsley, a Structure Analyst at Mike Albert. "Because of that, fleet owners want to work with an FMC that has an established, proven PLB process to ensure a smooth experience."

Vehicle inspections represent another crucial step. "We send our clients a link that they can share with their drivers," says Kinsley. "It walks them through what pictures to take of the vehicle and how to upload them so we can review them."

With all this data in hand, the FMC can then create a proposal detailing the new terms, monthly payments, and the amount of cash to be received.

The power of a matched depreciation strategy.

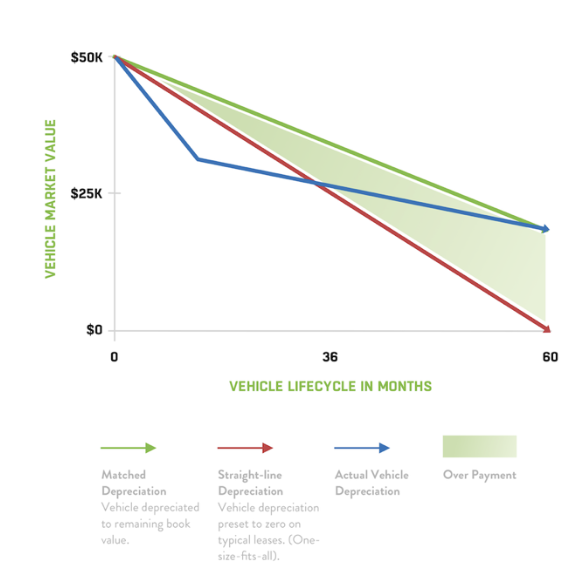

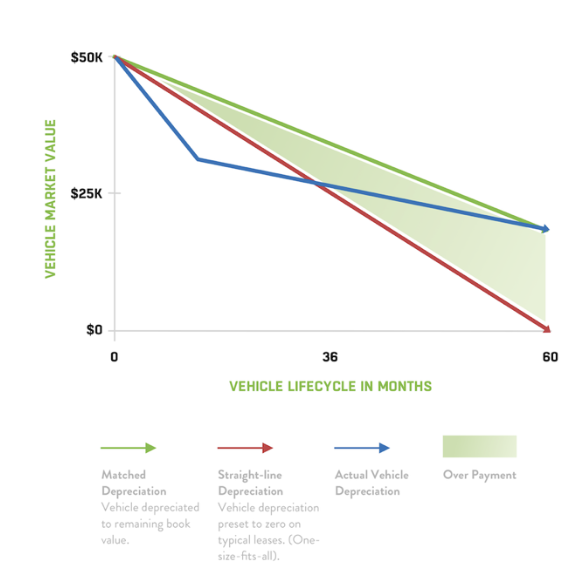

A key element to look for in a PLB program is one that, instead of depreciating vehicles to zero, depreciates them to match their fair market value at the end of the lease term. This way, fleets only pay for what they use, creating the best situation.

"On a 60-month payment plan, you're still hitting the sweet spot to avoid over-depreciation with aging vehicles," says Van Orden.

Simplified record-keeping and fewer hassles.

Many fleets juggle vehicle leases held by multiple lessors—banks, FMCs, and captive OEM finance organizations. This fragmented approach creates administrative complexity and billing confusion.

"In these situations, Purchase Lease Back consolidates billing for simplified record keeping," says Van Orden. "This eases the fleet's administrative burden and allows that attention to be devoted to more pressing matters."

Additionally, when an FMC owns your vehicles, it can relieve you of other administrative hassles, such as managing tolls and citations. Additionally, you don't need to worry about the various nuances involved in remarketing the vehicles.

Enjoy significant tax advantages.

Companies that engage with a PLB program can also benefit from several tax advantages, giving them the most working capital for their fleet. For instance, once a company sells its fleet vehicles and leases them back, the lease payments become a business expense. These payments are typically fully tax-deductible, reducing your company's income.

Depending on the lease structure, your company may also qualify for a Section 179 deduction, which allows businesses to deduct the full purchase price of qualifying equipment. In addition, should the sale of your vehicles result in a capital gain, that's typically taxed at a lower rate than ordinary income.

Involve all the key players.

Should you opt to pursue a PLB program, be sure to involve all relevant decision-makers from the start. This typically includes not only those who help manage the fleet but also those in finance and legal departments. If your current lessor is another FMC, it's best to obtain their written willingness to participate in the process. (Some FMCs will not sell vehicles to their competitors.)

Look for a true partner.

Sometimes, when all the facts are considered, it's better to cycle out some vehicles rather than involve them in a PLB program. "An FMC that's a true partner will counsel you on your best option for each vehicle rather than treat them all the same," says Kinsley.

To learn more about how a PLB program can propel your company forward, contact Mike Albert. "We've been in the leasing business for nearly six decades; in fact, we were one of the first companies in the country to lease vehicles to fleets," says Van Orden. "We're experts at arranging the best possible financing available given a company's specific fleet composition."

Frequently Asked Questions

Q: What's the minimum fleet size for a PLB program?

A: Most programs work best with fleets of 10+ vehicles, though exceptions exist based on vehicle value and creditworthiness.

Q: Can I include vehicles that are currently financed?

A: Yes, PLB programs can work with both owned and financed vehicles, often improving your overall financing terms.

Q: *How long does the process take? *

A: Typically, 30-45 days from application to funding, depending on fleet size and complexity.

Q: Are there any downsides to consider?

A: While PLB programs offer significant benefits, you'll no longer own the vehicles outright, and early termination fees may apply if you end leases before term completion.